- April 1, 2024

- Venturetax

- 0

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition. However, additional tax liability may arise due to errors or miscalculations. In such cases, the DRC-03 form is used to rectify these situations.

The DRC-03 Form, officially known as the “Intimation of Voluntary Payment,” is a critical tool for businesses to address additional GST liabilities. It facilitates the intimation of voluntary payments made by taxpayers before receiving a formal notice from the tax authorities. Additionally, it allows for the intimation of payments made within 30 days of receiving a Show Cause Notice (SCN) demanding tax payment.

Applicability of DRC-03

Voluntary Payment

If a taxpayer discovers an error and wishes to make a reasonable faith payment before a notice is issued, they can use the DRC-03 form. This proactive approach demonstrates a commitment to comply with the GST rules and can help prevent future complications.

Responding to Show Cause Notice (SCN)

When taxpayers receive a Show Cause Notice (SCN) demanding tax payment, they can use DRC-03 to comply within 30 days. This allows them to resolve their tax liability promptly and avoid further penalties.

DRC-03 Form: A Step-by-Step Guide

Filing a DRC-03 form is a relatively straightforward process. Here’s a breakdown of the steps involved:

- Access the GST Portal: First, log in to the official GST portal. Businesses must possess valid login credentials to proceed.

- Navigate to User Services: Once logged in, navigate to the “Services” section of the portal. Select “User Services” from there, followed by “My Applications.”

- Locate and Initiate the DRC-03 Application: Within “My Applications,” identify the option labeled “Intimation of Voluntary Payment – DRC 03.” Click on the “New Application” button to initiate the filing process.

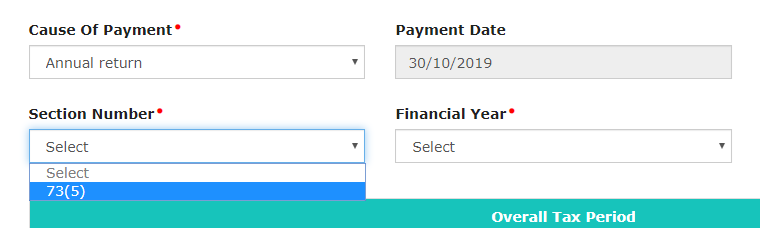

- Specify the Reason for Payment: The portal will prompt you to select the reason for utilizing the DRC-03 form. Choose between “Voluntary Payment,” “Annual Return,” “Audit,” or any other relevant option that applies to your situation.

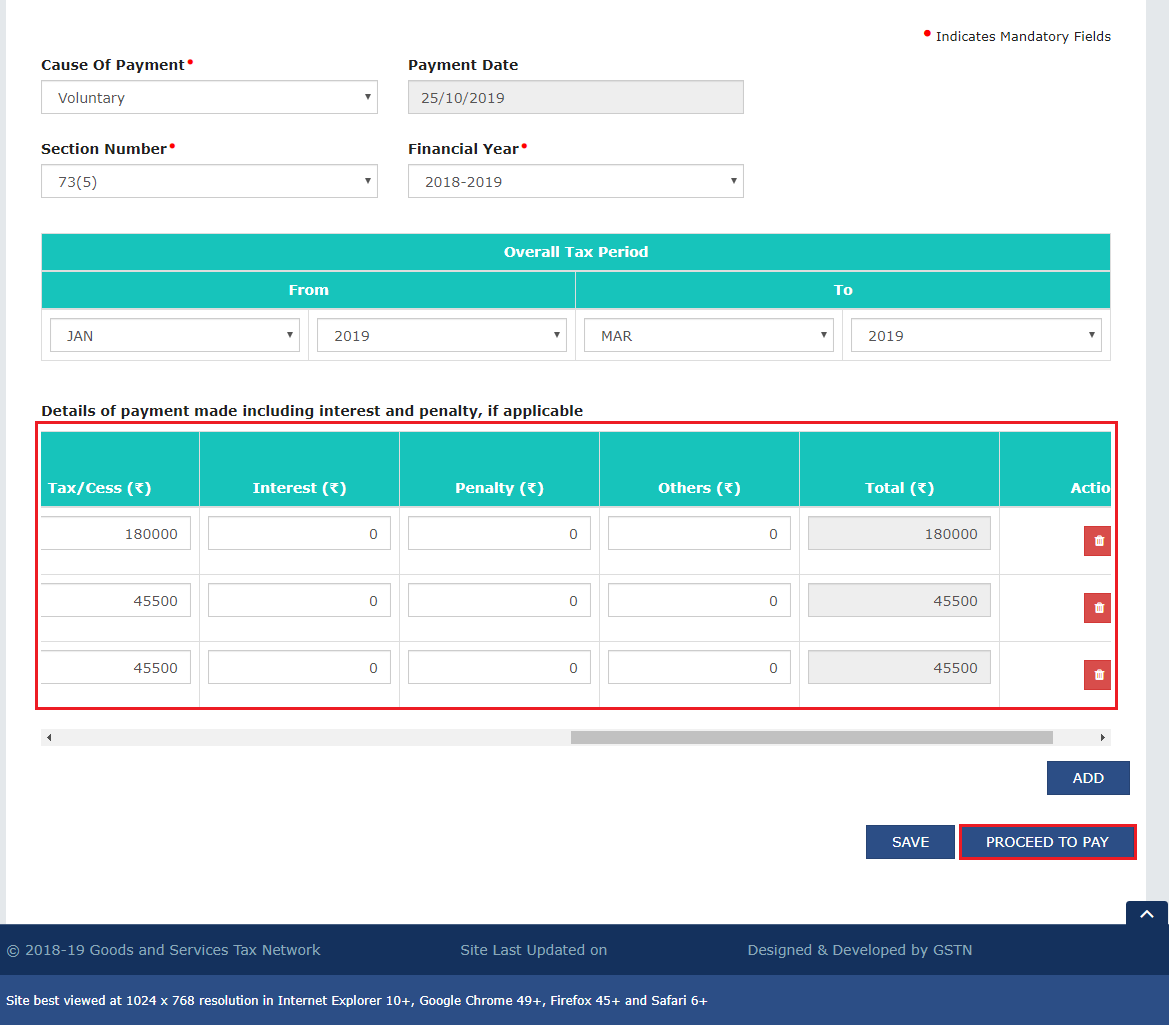

- Provide Payment Details: The form requires you to enter crucial details like the total tax amount payable, any applicable interest charges, and the challan details if the payment has already been made. A challan is a payment slip used to deposit taxes with the government.

- Verification and Submission: After meticulously reviewing the entered information for accuracy, submit the DRC-03 form electronically.

Should you require any assistance, please do not hesitate to contact us.

Benefits of Using DRC-03

Promptly addressing additional GST liabilities through DRC-03 offers several advantages for businesses:

- Avoidance of Penalties: By proactively intimating and settling the additional tax liability, businesses can shield themselves from hefty penalties imposed for late payment of GST.

- Demonstration of Good Faith: Utilizing DRC-03 showcases a business’s commitment to compliance with GST regulations. This fosters a positive relationship with the tax authorities.

- Early Dispute Resolution: Addressing discrepancies early on through DRC-03 helps prevent them from escalating into complex disputes with the GST department.

Frequently Asked Questions

What happens after filing DRC-03?

After filing DRC-03, the status changes to ‘Pending for approval by Tax officer.’ The taxpayer will receive an acknowledgment in Form GST DRC-041. The electronic liability register, cash ledger, and credit ledger will automatically get updated.

Where can cash payments be reported in GST returns?

Cash payments in GST returns are reflected in the Electronic Cash Ledger. All cash payments are reflected in the Electronic Cash Ledger in the Monthly Return in GSTR-3B.

When should a taxpayer make a payment in DRC-03?

A taxpayer should make payment in DRC-03 in the following scenarios:

- During an audit or reconciliation statement, if any case of short tax payment, interest penalties, or excess claim of the input tax credit is discovered.

- If the taxpayer is subject to investigation and it is revealed that the taxpayer had defaulted on incorrect tax payments.

- During the annual return reconciliation, if there is a fresh discovery of any short payment of taxes, interest, or penalties due to non-reporting or under-reporting taxable supplies.

- In response to a show-cause notice, the taxpayer can pay the tax demanded along with interest using DRC-03 within 30 days of the date of the issue mentioned in the notice.

What are the different reasons for using DRC-03?

DRC-03 is used in the following scenarios:

- Audit/Reconciliation Statement

- Investigation & Others

- Annual Return

- Demand or in response to show cause notice

- Liability Mismatch – GSTR-1 to GSTR-3B

Is there a deadline for using DRC-03 for voluntary payments?

Voluntary payment can be made either before the issuance of show cause notice or within 30 days of issue of SCN.

What additional information is needed while filing DRC-03?

While filing DRC-03, taxpayers must provide show cause notice details if payment is made within 30 days of its issue.

Can I make corrections after submitting DRC-03?

Yes, errors can be rectified in two ways. You can notice and voluntarily correct the error or get a Show Cause Notice (SCN). When you get a Show Cause Notice (SCN), you should pay it and make corrections within 30 days.

What if there is no sufficient balance in the cash ledger to make a voluntary payment in DRC-03 against a liability raised in an SCN?

You can pay the insufficient balance through an Electronic Cash Ledger. On the voluntary payment screen, you can select “Create Challan.” Then, the GST site will redirect you to the Payment mode. You can fill in the required amounts under appropriate tabs and make payment.

Where can I find help with filing DRC-03?

You can consult a tax professional or refer to official GST portal (www.gst.gov.in) guides for help filing DRC-03.

Need Tax Professional Consultant